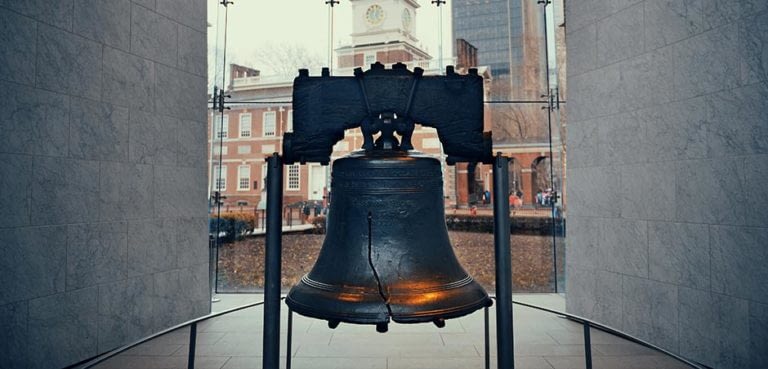

8 Unforgettable Pennsylvania Road Trip Destinations

Posted: August 4, 2021

One of the best ways to experience Pennsylvania in all its diversity and uniqueness is via road trip. Grab the kids, pack your car, and get ready to enjoy the state’s rich heritage and natural beauty. But before you take off, make sure you have the right auto insurance to protect your ride. Then, with peace of mind, explore these eight must-see destinations – and...

Lumber Prices Are Still Sky-High. Here’s How That Could Affect Your Homeowners Insurance.

Posted: August 4, 2021

If you’ve walked through your local home improvement store lately, you may have noticed that lumber prices are skyrocketing this year. In fact, the wholesale price of lumber hit an all-time high in May – climbing a staggering 323% since the start of the coronavirus pandemic in 2020. While there are signs that the market may be starting to cool as the U.S. economy reopens,...

Why You Should Consider Travel Insurance for Your Next Cruise

Posted: August 1, 2021

With summer coming to an end, you may be planning one last family trip before school starts again. If a cruise is on the horizon, you might want to consider travel insurance. COVID-19 has shown us how important this type of coverage could be, with the number of cancellations that have occurred. Benefits of Travel Insurance for a Cruise People generally book cruises to relax...

5 Employee Benefits That Promote a Strong Work-Life Balance

Posted: July 28, 2021

All employers want to have a team of loyal, dedicated workers, but what does it take? Today's generation of workers is seeking a more positive work-life balance. As an employer, you can foster higher employee loyalty by offering certain benefits to your current and prospective employees. Your employees are often married, building a family, and value working for a company that recognizes that life is...

How Much Life Insurance Do I Need?

Posted: July 22, 2021

Calculating how much life insurance involves evaluating your financial circumstances, which vary widely from family to family. In essence, you want a policy that will cover income loss due to death, provide your family with the capacity to pay off all bills, and provide your family with the financial support your dependents need. A basic calculation is to purchase a policy that pays out ten...